“The history of money is entering a new chapter. Countries are seeking to preserve key aspects of their traditional monetary and financial systems while experimenting with new digital forms of money. In recent years, CDBC has become a fancy concept, with many countries inclined towards it.”

Total digital payments in India have increased by 216% and 10% in terms of volume and trade, respectively, for March 2022 as compared to March 2019. This featured in an RBI report and that took a lot of people by surprise. The emergence of UPI has made this outcome imminent and the financial inclusivity of people in the country is going to increase rapidly as time proceeds. The Annual Budget of 2023 in India came with another historic statement from our Prime Minister as he laid out the concept of digital currency, particularly Central Bank Digital Currency, to further his objective of a digital cashless economy.

CBDC: The Digital Prodigy

So what is this, CDBC about which the whole buzz is going around? Picture this: cold, hard cash, but make it digital. That’s CBDC-a digital form of currency note that circulates in an economy. The Central Bank has cash reserves of various banks which form the monetary base for the economy. One is currency-notes and coins, basically the cash we hold in our wallets, but the other form of central bank money is reserves held by commercial banks. That’s accessible only to commercial banks for the big institutions, it’s not accessible to individuals. Now, central bank digital currency provides a new form of central bank money. CDBCs can be designed to have characteristics of both cash and reserves or deposits. Central Bank Digital Money is digitalized in the sense that it can be accessed from any mobile phone. CDBCs are of two types: retail, one for the private sector, and wholesale, for the financial institutions. The transactions are recorded with the help of blockchain technology. Blockchain is a chain of blocks that helps in the storage of data ranging from financial transactions to logistics and whatnot. It can be described as a “digital database”. Similar technology is used in crypto, – so a common apprehension that arises in rational minds is whether it will be as volatile as crypto is. It has some common roots in terms of technological development, but it has a much better foundation in terms of policy credibility and the trust that we need in money. That’s a vital aspect of maintaining public confidence, and that is because they are government-controlled and stabilised by the government for the effective functioning of the economy.

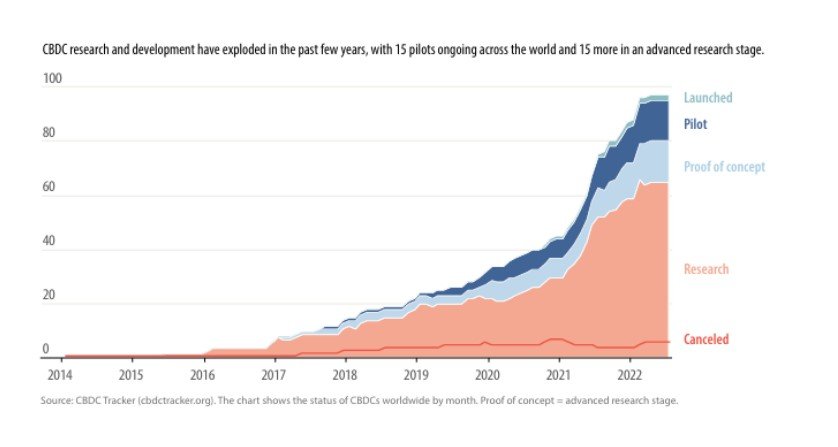

Some might believe that it is a new concept, but we find traces of its presence around 1993 when the Bank of Finland launched the Avant smart card, an electronic form of cash. Although the system was eventually dropped in the early 2000s, it can be considered the world’s first CBDC. But not until recently has research into CBDCs proliferated globally, prompted by technological advances and a decline in the use of cash. Central banks all over the world are now exploring their potential benefits, including how they improve efficiency and safety. Many countries have already launched it, and the number of countries performing pilot runs for it is constantly increasing. CBN has already launched the eNaira, Africa’s first-ever CDBC. Even India launched it, recently, taking a huge stride towards the digital trend that is booming in the country. As of 2022, data presented by the IMF shows these trends in CDBCs.

CDBCs, to some, might seem similar to UPIs or the digital payment methods prevalent in the economy, but what CDBCs have done is exclude the banks as the intermediaries. When credit cards or debit cards make the payments, usually the bank charges a fee to the seller, and the seller does not receive the exact amount that he ought to receive. It’s usually 1.5% at least, and sometimes as high as 4 or 5%. This goes to the bank. So, that’s why some merchants don’t accept credit cards. And that also reflects the very complicated clearing and settlement structure behind settling a credit card transaction, right? So, it’s multilayered. CDBCs dissolve this problem in the economy and fill the gap in the sector. The continuous role of the banks as middlemen is eliminated.

CDBCs have another interesting perspective on it. Governments have an idea of launching offline digital money. The development of offline CDBCs may have its roots in the technological past. Countries have long been inclined towards developing a system of digital payments that is offline to increase financial inclusivity. Offline digital payment systems could verify the availability of funds and validate transactions without the need to check in with an online ledger. They could use old-tech, non-internet-driven mobile phones or something like a souped-up stored-value card. Back in 1993, the Bank of Finland launched its Avant stored-value card. It was capable of offline payments using a custom-made card reader device, but it never caught on and was dropped in 2006. So people with mobile phones with no access to the internet could also be brought into the framework of the digital cashless economy. Even the Central Bank of Canada conducted a pilot run of CDBC on

feature phones. The loopholes, or rather, the people uncovered under the UPI scheme, will be removed. This ensures wider coverage and also aligns with one of the major goals of various countries, including, India, i.e. Atmanirbhar Bharat.

Cross-Border Capers

The dire need for several economies to transition to digital currency is a need that has been created mainly due to cross-border payments and financial inclusivity. In a recent report that assessed the performance of the eNaira, the digital currency of Africa, it was revealed that the cost of sending remittances to the domestic economy has been drastically reduced as people can hold the digital currency in merchant wallets, via which they can be directly transferred to another wallet without any intervention by any financial institution. Taking it further, cross-border payments can be made quite easily. In some corridors particularly in low-income countries, it has been found that a huge fee is charged for the cross-border payments, about 10-20%, but with the introduction of CDBCs, it can be drastically reduced, which will be of major help to the migrant workers sending remittances back home. The major challenges faced currently in cross-border payments are the high operational costs and speed with which the transactions are processed and the money involved is transferred. CDBCs are out to solve these issues as they would have lower costs due to scale and network economies. As it is regulated by the central bank, the issue of transparency would also not be a big concern.

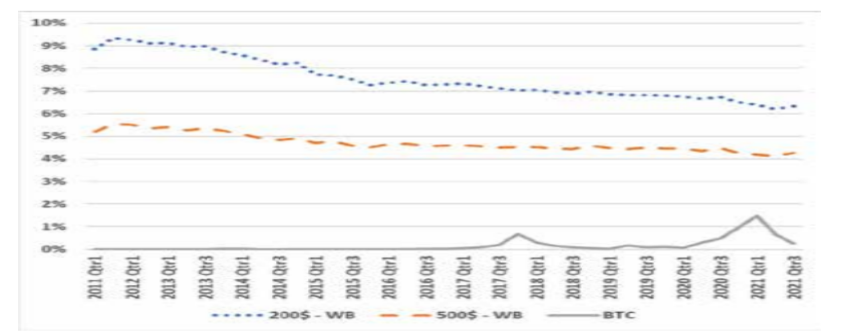

According to data published by the World Bank, comparing the transaction costs of sending remittances by cryptocurrencies using blockchain technology and via commercial banks, it was found that crypto turned out to be way more cost-efficient.

The CDBCs using the same technology could resemble each other. Hence it would enable us to come closer to one of the goals of reducing this cost as laid down by the World Bank in the data report. One of the G20 summits contemplated increasing cross-border payments by having a look at the international dimension of CBDC designs, further advocating its advantage.

But as more countries launch CBDC pilot projects, concerns about cybersecurity and privacy loom large. Federal Reserve Chair Jerome Powell recently listed “cyber risk” as his number one worry relating to financial stability, and a recent UK House of Lords report specifically described cybersecurity and privacy risks as potential reasons not to develop a CBDC. The cyber risks are imminent, and the threat is quite high. However, the risks associated with centralised data collection can be mitigated either by not collecting it at all or by choosing a validation architecture in which each component sees only the amount of information needed for functionality. This can be ascertained by some tools, like Zero-Knowledge Proof and hashing. For example, Project Hamilton (a joint effort by the Boston Federal Reserve and the Massachusetts Institute of Technology to explore a US CBDC) has designed a system that separates transaction validation into phases, and each phase requires access to different parts of the transaction data. This also answers another issue that is prevalent in the minds of the users, which is privacy concerns. Technology enables central banks to ensure that cybersecurity and privacy protection are embedded in any CBDC design.

CBDC vs. Banks: No More Middlemen!

CDBCs would be carrying an interest rate, and more possibly, it could be a situation when we find that the central bank would be following the policy of a negative interest rate to increase spending in the economy during a recession. Due to the presence of flexibility to convert this digital form of money into cash very easily, people would be hoarding cash, and the ultimate purpose of the monetary and fiscal policy might be harmed. This might prove detrimental to the overall stability of the economy. The role of banks might be crowded out as banks will be removed as intermediaries in this, though it has not been proven. E-Naira launched in SSA (Sub-Saharan Africa) economies do not suggest so, but that might be due to the low number of customer databases that exist there. As CDBCs provide a safer and more lucrative option to save your money in digital form, people might turn their bank toward commercial banks, again harming the interests of the economy. The bank deposits being phased out means that there might be several implications for the economy. According to a report, bank deposits were reduced by a major 4 -5% after the introduction of CDBCs, and the condition could be worse. Even what it does is hurt the credit creation capacity of the economy. Thus, the central banks need to be cautious. This might be mitigated by setting a limit on CDBC holdings by a particular person, but its feasibility is a huge doubt. The transition, if possible, from the traditional cash economy to a total digital economy can go a long way ahead. It’s not too far that we would be able to make payments using our wearables, like watches, etc. This is not too far away in the future; actually for example, during the Winter Olympics in Beijing, they already provided wristbands and/or bracelets that were used as wearables.

The Road Ahead.

The data representation clearly states the magnitude of interest that CBBCs are gathering. The history of money is entering a new chapter. Countries are seeking to preserve key aspects of their traditional monetary and financial systems while experimenting with new digital forms of money. In recent years, CDBC has become a fancy concept, with many countries inclined towards it. The primary reason is the ubiquitous presence of mobile phones in each pair of hands, as well as due to the drastic improvement of the Internet of Things. Second, recent years have seen an explosive growth of digital assets. This was fueled by innovative blockchain technologies, a desire for censorship-free financial transactions, and some bandwagon effects. But it comes with its counterparts, and it cannot be ignored either. There is a dark side to this world of digital currencies that lurks in the shadow, and that is the cyber risks it brings along with it. It would not take people too long to find methods to defraud people using this and thus enrich unjustly. The commercial banks may face a huge hit for which the economy might not be ready. The need of the hour is striking a balance between the two. Introducing a CBDC is about finding the delicate balance between developments on the design front and the policy front. Getting the design right calls for time and resources, and continuous learning from experience—including shared experiences across countries can help to take it a long way. The arrival of CDBCs is imminent and the economy has to adapt to its shortcomings accordingly. As digitalisation unfolds, let’s fasten our seat belts as CDBCs play their cards, which might be a rollercoaster ride with its own bright and dim sides as the CDBCs throw a curveball at the prevailing financial system.

By:-Sidharth Dugar

References:

Author_Id, N. (2021). Central bank digital currencies for cross-border payments. https://doi.org/10.1596/36764

Central bankers’ new cybersecurity challenge. (2022, September 1). IMF. https://www.imf.org/en/Publications/fandd/issues/2022/09/Central-bankers-new-cybersecurity-challenge-Fanti-Lipsky-Moehr

Dong He on central bank digital currencies. (2022, July 21). IMF. https://www.imf.org/en/News/Podcasts/All-Podcasts/2022/07/21/fintech-forward-ep2-dong-he

Manickanamparambil, R. B. (2023, February 12). WHAT IS CENTRAL BANK DIGITAL CURRENCY (CBDC)? – Xavier’s finance community. https://xaviersfinancecommunity.com/publications/tribune/what-is-central-bank-digital-currency-cbdc/

Ree, J. (2023). Nigeria’s ENaira, one year after. IMF Working Paper, 2023(104), 1. https://doi.org/10.5089/9798400241642.001

Sajter, D. (2022). Overseas Transaction Fees: Sending Money via Bitcoin vs. Banks. Zagreb International Review of Economics and Business, 25(s1), 65–83. https://doi.org/10.2478/zireb-2022-0025

Taking digital currencies offline. (2022, July 30). IMF. https://www.imf.org/en/Publications/fandd/issues/2022/09/kiff-taking-digital-currencies-offline

Tan, H. C. G. G. M. (2023, November 18). Central Bank digital currency and bank disintermediation in a portfolio choice model. IMF. https://www.imf.org/en/Publications/WP/Issues/2023/11/18/Central-Bank-Digital-Currency-and-Bank-Disintermediation-in-a-Portfolio-Choice-Model-541607

The ascent of CBDCs. (2022, September 1). IMF. https://www.imf.org/en/Publications/fandd/issues/2022/09/Picture-this-The-ascent-of-CBDCs

The Future of money: Gearing up for central bank digital currency. (2022, February 9). IMF. https://www.imf.org/en/News/Articles/2022/02/09/sp020922-the-future-of-money-gearing-up-for-central-bank-digital-currency

World Bank Group. (2023, August 1). Remittances to Reach $630 billion in 2022 with Record Flows into Ukraine. World Bank. https://www.worldbank.org/en/news/press-release/2022/05/11/remittances-to-reach-630-billion-in-2022-with-record-flows-into-ukraine#:~:text=Remittances%20to%20Reach%20%24630%20billion%20in%202022%20with%20Record%20Flows%20into%20Ukraine,-Share%20more&text=WASHINGTON%2C%20May%2011%2C%202022%20%E2%80%94,year%20to%20reach%20%24630%20billion.