Published in:

Business And Finance

To Privatize or Not to Privatize?

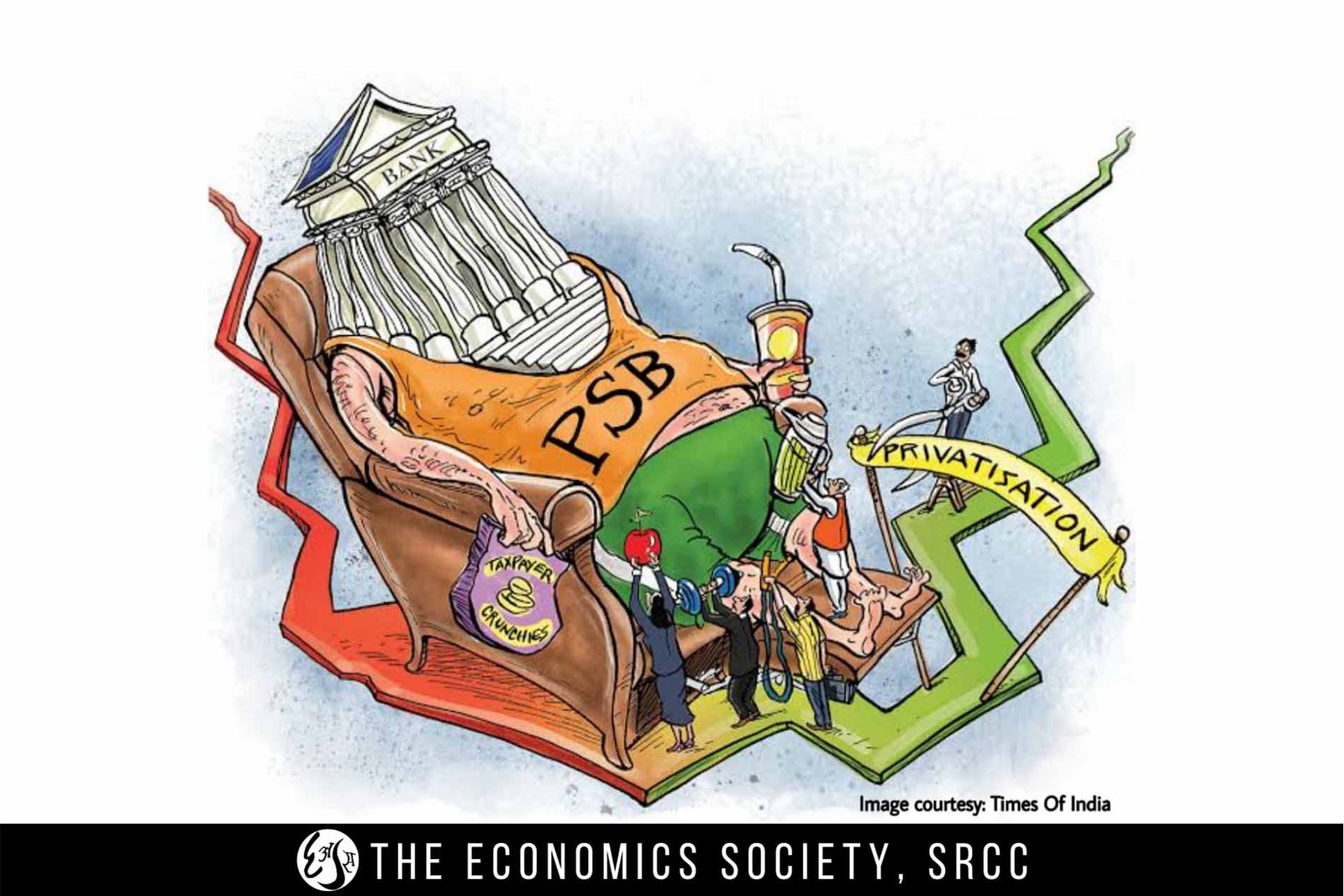

The state of public banks in India is deteriorating; in fact to say that they are deteriorating would be an understatement. These banks which were set up with the indispensable goal of achieving social development and amelioration of the poor section of the society have diverted from their aim. The status quo tells us that these banks are stuck in the cobweb of crony capitalism, worsening asset quality, generating NPAs (Non-Performing Assets), stressing balance sheets -snowballing into a big problem, the effect of which could be catastrophic to the banking sector, to say the least.

The most pertinent problem of the PSU banks at present is the proliferating NPAs. The nexus of politicians, bureaucrats and industrialists have a big role to play in this. The public sector banks are suffering from the problem of NPAs majorly due to restructuring of loans. This means that even when a specific party has not paid their previous loan amounts, these banks lend them further loans without the full payment of the prior amount which escalates the problem of bad assets. This is also what is called as ‘evergreen lending’. But who are these borrowers? Public sector banks in India follow a policy of ‘priority sector lending’ which means that they extend a certain proportion of funds to some specific sectors. These sectors at many times have business leaders who have close ties with the government officials. This in fact precisely encapsulates what crony capitalism is all about. The business leaders take advantage of their connections with politicians and tap it to relax the terms of the loans. And these borrowers are majorly from sectors like infrastructure, power-mostly heavy industries where crony capitalism is prevalent. All the major sectors (infrastructure, particularly power, retail, SSIs and iron and steel) that are reeling under the NPA crisis were privatized to a large extent after the economic reforms of 1991. So, before 1991, these sectors were completely owned by the government, and hence the priority had never been returns until they were privatized. Now, if a project is not viable, it is the private sector which has to bear the brunt of losses, resulting in defaults, and consequently NPAs. Is the pre-1991 scenario of the government suffering huge fiscal deficits because of huge losses in such sectors better than the present scenario where balance sheets of both the banks and the borrowers have been suffering and consequently, affecting the private investments in the Indian economy?

Further, the public sector banks also have inefficiencies in terms of monitoring, follow-up of the defaulters and credit appraisal. These problems have aggravated so much that in order to even privatize these banks, they have to be first flushed out of all the bad assets or the NPAS. Creating a bad bank for all NPAs is certainly not a viable option. A bad bank is essentially a bank to which all the NPAs are sold so that the banks can have less-stressed balance sheets and the capital adequacy can be improved. If the government controls and creates a bad bank it will certainly have a problem in terms of where the funds to operate these banks would come from. Further, the government will have a paucity of specialists needed to manage these bad loans coming from all PSBs. This clearly and simply means that creating a bad bank for NPAs of the PSBs is like transferring the problem from one unit of the government to the other while the problem still persists!

Another problem is that these banks show their balance sheet to be rosier than it actually is. Following this practice of ‘window dressing’, they want to-in essence-continue with this practice of evergreen lending and that is majorly because of the ties that government officials have with the business honchos. But this window dressing of balance sheets does not take away from the reality of the ‘festering twin balance sheet problem’ which means that the balance sheets of both the banks and the corporates are under stress. The banks have a problem of proliferating NPAs and the corporates have a dearth of funds to repay the loans, which lead to deteriorating condition of the balance sheet for both. The business honchos are a good vote bank for these officials who may be loyal to a particular political party. The problem in the public banks today has therefore been further complicated by politics. Take the example of Vijay Mallya. He was given a whopping INR 8040 crore loan in the year 2004 and it took 5 years for SBI to declare that loan as an NPA. Furthermore, the loan was even restructured in 2010. All these glaring deficiencies in the public sector banks do tell us how all work these banks have done for rural development has perhaps been overshadowed by their present state which is brimming with increasing bad assets.

In this scenario, privatization does seem a viable way to move out of the deadlock. This is because privatization of loss-making and sick PSUs will ensure that the economy grows in a robust manner as the sick units will no longer add to the already increasing pool of NPAs and as the private units would always want that their entities are in good health, so they would be over-cautious regarding the issue of NPAS. The intricacies of such a move will surely have to be figured out. Complete privatization will also mean that the social ramifications would be negative. There has to be a government control with regard to that too. Do we merge the poor performing PSBs or totally privatize all public sector banks are questions that need to be answered. Merging all PSBs does not seem an attractive choice as mergers lead to reduced efficiency, job cuts, and a lot of administrative costs and paperwork. Further, what will be the mode of privatization i.e. whether it will be through an IPO or asset sales also needs to be looked at. The issue at hand is far more complex than it ostensibly seems. Privatization does seem a panacea for the present ‘NPA- ill’ but how should it be exactly done is the question and still needs to be pondered over.

By Sanket Jain.

The most pertinent problem of the PSU banks at present is the proliferating NPAs. The nexus of politicians, bureaucrats and industrialists have a big role to play in this. The public sector banks are suffering from the problem of NPAs majorly due to restructuring of loans. This means that even when a specific party has not paid their previous loan amounts, these banks lend them further loans without the full payment of the prior amount which escalates the problem of bad assets. This is also what is called as ‘evergreen lending’. But who are these borrowers? Public sector banks in India follow a policy of ‘priority sector lending’ which means that they extend a certain proportion of funds to some specific sectors. These sectors at many times have business leaders who have close ties with the government officials. This in fact precisely encapsulates what crony capitalism is all about. The business leaders take advantage of their connections with politicians and tap it to relax the terms of the loans. And these borrowers are majorly from sectors like infrastructure, power-mostly heavy industries where crony capitalism is prevalent. All the major sectors (infrastructure, particularly power, retail, SSIs and iron and steel) that are reeling under the NPA crisis were privatized to a large extent after the economic reforms of 1991. So, before 1991, these sectors were completely owned by the government, and hence the priority had never been returns until they were privatized. Now, if a project is not viable, it is the private sector which has to bear the brunt of losses, resulting in defaults, and consequently NPAs. Is the pre-1991 scenario of the government suffering huge fiscal deficits because of huge losses in such sectors better than the present scenario where balance sheets of both the banks and the borrowers have been suffering and consequently, affecting the private investments in the Indian economy?

Further, the public sector banks also have inefficiencies in terms of monitoring, follow-up of the defaulters and credit appraisal. These problems have aggravated so much that in order to even privatize these banks, they have to be first flushed out of all the bad assets or the NPAS. Creating a bad bank for all NPAs is certainly not a viable option. A bad bank is essentially a bank to which all the NPAs are sold so that the banks can have less-stressed balance sheets and the capital adequacy can be improved. If the government controls and creates a bad bank it will certainly have a problem in terms of where the funds to operate these banks would come from. Further, the government will have a paucity of specialists needed to manage these bad loans coming from all PSBs. This clearly and simply means that creating a bad bank for NPAs of the PSBs is like transferring the problem from one unit of the government to the other while the problem still persists!

Another problem is that these banks show their balance sheet to be rosier than it actually is. Following this practice of ‘window dressing’, they want to-in essence-continue with this practice of evergreen lending and that is majorly because of the ties that government officials have with the business honchos. But this window dressing of balance sheets does not take away from the reality of the ‘festering twin balance sheet problem’ which means that the balance sheets of both the banks and the corporates are under stress. The banks have a problem of proliferating NPAs and the corporates have a dearth of funds to repay the loans, which lead to deteriorating condition of the balance sheet for both. The business honchos are a good vote bank for these officials who may be loyal to a particular political party. The problem in the public banks today has therefore been further complicated by politics. Take the example of Vijay Mallya. He was given a whopping INR 8040 crore loan in the year 2004 and it took 5 years for SBI to declare that loan as an NPA. Furthermore, the loan was even restructured in 2010. All these glaring deficiencies in the public sector banks do tell us how all work these banks have done for rural development has perhaps been overshadowed by their present state which is brimming with increasing bad assets.

In this scenario, privatization does seem a viable way to move out of the deadlock. This is because privatization of loss-making and sick PSUs will ensure that the economy grows in a robust manner as the sick units will no longer add to the already increasing pool of NPAs and as the private units would always want that their entities are in good health, so they would be over-cautious regarding the issue of NPAS. The intricacies of such a move will surely have to be figured out. Complete privatization will also mean that the social ramifications would be negative. There has to be a government control with regard to that too. Do we merge the poor performing PSBs or totally privatize all public sector banks are questions that need to be answered. Merging all PSBs does not seem an attractive choice as mergers lead to reduced efficiency, job cuts, and a lot of administrative costs and paperwork. Further, what will be the mode of privatization i.e. whether it will be through an IPO or asset sales also needs to be looked at. The issue at hand is far more complex than it ostensibly seems. Privatization does seem a panacea for the present ‘NPA- ill’ but how should it be exactly done is the question and still needs to be pondered over.

By Sanket Jain.